- Shanghai Zhongshen International Trading Co., Ltd. – Your reliable partner with 20 years of import/export agency service expertise.

Export Agent ServicesWhat items are included in the basic service fee?

The basic service fee for professional export agency typically includes four core modules:Document Preparation Fee(Commercial invoice, packing list,Origin Certificateetc.),Customs declaration fee,Logistics coordination fee?and?Basic Compliance Review Fee. According to the latest data from the General Administration of Customs in 2025, the average market price for basic service fees fluctuates between 0.8% and 1.5% of the cargo value, depending on:

- Regulatory level of goods HS code

- Tariff policies of export destination countries

- Document complexity (e.g., whether embassy certification is required)

How is the advance payment tax refund service billed?

For export enterprises in need of capital turnover, the agency offers an advance tax refund service that adoptsTiered Fee System:

- The funding period is ≤30 days: A fee of 0.3%-0.5% of the tax refund amount will be charged.

- 31-60 days: Charge 0.6%-0.8%

- Special industries (e.g.?photovoltaic?A 0.2% risk premium may be added to the component.

Special attention should be paid to the new 2025 edition of the "Tax RebatesThe "Management Measures" require agents to publicly disclose the cost structure of advance funding, and it is recommended that agents be required to provide bank transaction records as proof.

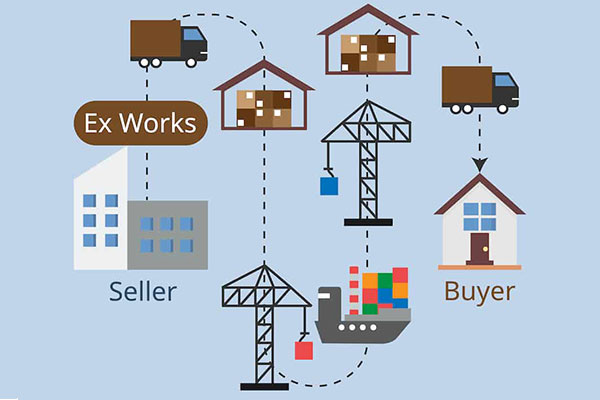

How do different trade terms affect the agency fee?

According to the revised content of the Incoterms 2025, agency fees are strongly correlated with trade terms:

- EXW terms: The agent shall be responsible for the entire domestic service process, with costs increasing by 15%-20%.

- FOB terms: Base cost + Pre-calculation of destination port miscellaneous fees

- DDP terms: The customs clearance service fee of the destination country needs to be added (usually 3%-5% of the CIF value).

How to identify hidden charging traps?

The 2025 industry survey reveals that 73% offoreign tradeThe company has encountered hidden fees in agency services, primarily existing in:

- Sudden commodity inspection fees (e.g., FDA inspection fees)

- Exchange Rate Fluctuation Compensation (charged when exceeding the agreed fluctuation range)

- Expedited fee for special documents (e.g., CO issuance within 3 working days)

It is recommended to clearly stipulate in contractscost ceiling clauses, and request the agent to provide the actual fee schedule for similar services over the past three years.

How to evaluate whether the agent's quotation is reasonable?

Professional judgment can be conducted from three dimensions:

- Market condition comparison: Refer to the industry guidance price released by the China International Freight Forwarders Association in Q1 2025.

- Service Granularity Matching: Check whether the quotation distinguishes between basic services and value-added services.

- Risk assumption ratio: High-quality agents typically include a 1%-3% compliance risk deposit.

Typical Case: In a project involving the export of electronic products to Europe, the agent's quoted rate of 1.2% appeared lower than the market price. However, it did not include CE certification services, resulting in an actual comprehensive cost of 1.8%, which was higher than the industry average.

Special Reminder: In 2025, multiple free trade zones will implement new customs clearance facilitation policies. It is recommended to prioritize agencies with physical service networks in special regulatory areas such as the Hainan Free Trade Port and the Shanghai Lingang New Area, which can save approximately 0.3% in compliance costs.

Resources

Contact Us

Email: service@sh-zhongshen.com

Related recommendations

Contact via WeChat

? 2025. All Rights Reserved.